It was another case of “so near, yet so far” for Brighton

and Hove Albion last season, as the Seagulls missed out on automatic promotion

to the Premier League only on goal difference, while a spate of untimely

injuries led to defeat in the play-off semi-finals by Sheffield Wednesday, who

had finished a full 15 points behind them in the league table.

Chairman Tony Bloom captured the feelings of the Albion

fans: “The 2015/16 season was one of the most remarkable and exciting in my 40

years as a Brighton and Hove Albion supporter. The team, under Chris Hughton’s

astute leadership, gave us a season to savour – and although we twice missed

out on taking that final step to the Premier League, it has laid the foundation

for our current season.”

This is the third time in the last four seasons that

Brighton have reached the Championship play-offs, only to fall in the semis.

This consistency on the pitch is all the more impressive, as it has been

achieved under different managers: Guy Poyet in 2013; Oscar Garcia in 2014; and

Hughton last year. The only blip came in 2015, when the club slipped back under

the far-from-flying Finn Sami Hyypia.

"Many Happy Returns"

Of course, for those with longer memories it is great news

that Brighton are still around to mount a challenge, given that they only

avoided dropping out of the Football League to the Conference by the skin of

their teeth in 1997 with a final day 1-1 draw at Hereford United.

There then followed years of struggle, exacerbated by the

problems of finding a suitable ground after the Goldstone was sold to property

developers, leading to exile in Kent and a ground share with Gillingham. The

club returned to Brighton two years later to the Withdean, an old council-owned

athletics stadium where the facilities were far from ideal.

It took 12 years, but finally Brighton moved to the magnificent

new Amex stadium in 2011, coinciding with promotion to the Championship. The

major investment required to build the stadium (and indeed a superb new

training centre) was funded by Bloom, a lifelong fan who became chairman.

He has continued to finance the club, as can be seen by the

2015/16 accounts, which revealed a massive £25.9 million loss, £15.4 million

worse than the previous season’s £10.4 million loss. To put that into

perspective, that means that Brighton lost more than £2 million a month or

around £500,000 every week.

The club said that this underlined Bloom’s commitment and in

particular the ambition to reach the Premier League, while the chairman himself

explained the strategy: “Our increased losses result directly from an ongoing

and growing investment in our playing squad.”

This explains the main reasons for the higher loss, as wages

shot up £6.7 million (33%) from £20.6 million to £27.4 million, while player

amortisation (the annual cost of transfer fees) also rose £1.4 million (60%)

from £2.4 million to £3.8 million. Moreover, the desire to retain players meant

that profit from player sales fell £7.5 million from £8.7 million to just £1.2

million.

In addition, other expenses also increased by £1.1 million

(7%) from £15.0 million to £16.0 million, largely due to higher costs

associated with running the stadium.

The sizeable cost growth more than offset the £1.0 million

(4%) increase in revenue from £23.7 million to £24.6 million, mainly due to

broadcasting income rising £0.9 million (18%) to £5.9 million, though

commercial income was also up £0.5 million (8%) to £9.4 million, driven by

catering and events. On the other hand, gate receipts fell £0.4 million (4%) to

£9.4 million, primarily due to no home cup ties.

Other operating income was up £0.4 million, thanks to other grants

received.

In fairness to Brighton, almost all clubs in the

Championship lose money and are reliant on owners’ funding. In 2014/15, the

last season where all clubs have published their accounts, losses were reported

by 18 of the 24 clubs – in stark contrast to the Premier League where the new

TV deal, allied with wage controls, has led to a surge in profitability.

The club that made most money in the Championship that

season were Blackpool – and their model is not one to be recommended, as it

culminated in relegation to League One. As Bloom noted, “Any Championship club without

parachute payments wishing to compete for promotion will inevitably make

significant losses.”

That said, Brighton’s loss of £26 million in 2015/16 is

likely to be one of the highest in the division. Only two clubs reported higher

deficits in 2014/15: Bournemouth £39 million, though their loss was inflated by

£9 million promotion payments and an £8 million fine for failing Financial Fair

Play (FFP); and Fulham £27 million, but this was impacted by £11 million of

exceptional impairment charges.

Brighton could have reduced their loss by accepting some of

the lucrative offers received for their top talents, but Bloom noted that the

club made a conscious decision “to retain our key players” and “not to cash in

on our key assets”.

Consequently, there were no significant player disposals in

the 2015/16 season, leading to only £1.2 million profits, probably driven by

additional clauses from earlier player sales, as the contingent receivables on

transfers have fallen from £2.1 million to £0.8 million in the latest accounts.

In comparison, £8.7 million was booked in the previous season, mainly from the

sales of Leo Ulloa to Leicester City and Will Buckley to Sunderland.

Although Championship clubs rarely sell players for big

bucks, at least compared to the Premier League, this was a useful money-spinner

for Brighton in 2014/15 with only four clubs generating more money from this

activity. In contrast, the 2015/16 profit of just over £1 million is likely to

be one of the smallest in the division.

Of course, losses are nothing new for Brighton. In fact, the

last time that they made a profit was back in 2007/08 – and that was less than

£1 million and only arose because of a £3.6 million exceptional credit, due to

a change in the accounting for the Falmer stadium expenses. Since then, the

club has made cumulative losses of £88 million.

Moreover, the losses have been growing. Since promotion to

the Championship, Brighton’s total losses have amounted to £71 million, averaging

£14 million a season. As finance and operations director David Jones confirmed,

“We’ve lost money every year we’ve been (at the Amex).”

Jones added, “While we’re getting a competitive team on the

pitch, we’re going to continue to lose money with the revenue streams that

we’ve got.” The difference with the top flight is colossal. Jones again, “If we

were in the Premier League, we would be able to be a sustainable business that

makes an annual profit.”

If they are not promoted, it will be interesting to see what

the board decides regarding player sales. Traditionally Brighton have made very

little from the transfer market , though there was a change in stance in

2013/14 when the club sold Liam Bridcutt to Sunderland and Ashley Barnes to

Burnley, followed by the even more profitable sales in 2014/15.

This summer Brighton could have made a lot of money if they

had accepted all the offers they received, e.g. Dale Stephens (Burnley), Lewis

Dunk (Fulham) and Anthony Knockaert (Newcastle United). That could have brought

in £15-20 million, though obviously would have damaged Brighton’s prospects of

promotion.

The current strategy is to “speculate to accumulate”, but as

Bloom has admitted, “It would be ridiculous for me or any owner to say that a

player is never for sale. There’s always a price for any player.”

Brighton’s strategy is more clearly seen by the club’s

alternative presentation of the profit and loss account, which highlights the

29% (£7 million) increase in the football budget in 2015/16.

Chief executive Paul Barber, who has overseen a “pretty

radical and dramatic programme of reducing our costs” explained the approach as

follows “It gives us more opportunity to put more into the football budget,

which should improve our chances of promotion.”

In this way, administrative and operational costs have been

cut by 22% since 2012, which has meant that Brighton’s different managers have

benefited from a significant increase in the football budget over this period

of around 134%, as it has grown from £13 million to £31 million.

Bloom praised his team for “ensuring we remain operationally

efficient”, but the reality is that Brighton’s underlying profitability has

still been getting worse, as seen by the reduction in EBITDA (Earnings Before

Interest, Depreciation and Amortisation).

This metric is considered to be an indicator of financial

health, as it strips out once-off profits from player trading and non-cash

items. It has been consistently negative at Brighton, but has declined in the

last eight years from minus £3 million in 2008 to minus £18 million in 2016.

Unsurprisingly, a negative EBITDA is far from uncommon in

the Championship with 21 clubs generating cash losses, though only Nottingham

Forest have worse underlying figures than Brighton. In stark contrast, in the

Premier League only one club reported a negative EBITDA, which is again

testament to the earning power in the top flight.

Brighton’s revenue surged from £7.5 million in 2011 to £24.6

million in 2016 following promotion from League One to the Championship,

exacerbated by what can be described as the "Amex effect" with gate receipts

being more than four times as much as Withdean,

increasing from £2.3 million to £9.4 million.

In addition, the new stadium has brought more commercial

opportunities, leading to income climbing from £3.1 million to £9.4 million.

The club could negotiate better deals with sponsors in the higher division (up

from £0.8 million to £5.5 million), increase retail sales, e.g. from the

stadium megastore (up from £0.5 million to £1.3 million) and make more from

catering, i.e. pies and the famous Harveys beer (up from £35k to £1.3 million).

However, the growth since the first season back in the

Championship in 2012 is less impressive, amounting to just 11% (£2.5 million)

in four years. The fact is that it is difficult to substantially grow revenue

streams without another promotion to the top flight.

Brighton’s revenue of £25 million places them around 7th

highest in the Championship, but the clubs with the three highest revenues in

2014/15 (Norwich City, Fulham and Cardiff City ) were more than 60% higher with

£40-52 million.

Bloom is acutely aware of the challenge this poses: “Our

player budget is the highest it has ever been, so we have certainly invested,

but we absolutely can't compete financially with relegated clubs like QPR,

Burnley and Hull with their parachute payments.”

He’s not wrong, as two of the three clubs he named were

promoted back to the Premier League last season, once again proving that money

talks in football. Jones reiterated his chairman’s message, noting that this factor

“presents difficulties when trying to assemble a playing staff that can compete

with clubs coming down from the Premier League, whose TV parachute payments can

inflate their revenue to around £40 million.”

Excluding the impact of the parachute payments made to those

clubs relegated from the Premier League (£26 million in first year after

relegation) Brighton’s revenue would be one of the highest in the Championship.

This season the disparity between “the haves and the have nots” will be even

larger, as the relegated clubs include Newcastle United and Aston Villa.

Even Chris Hughton has commented on this hurdle, when

discussing Newcastle: “They’ve come down with parachute payments, they are a

massive club and they are doing their very best to make sure they go straight back

up again.”

The majority of Brighton’s revenue comes from the stadium

with gate receipts contributing 38%, up from 30% at Withdean, though this

is only just ahead of commercial income 38%, following the relatively higher

growth rate in the last few seasons. Broadcasting is up to 24%, though this is

much lower than the Premier League, where TV money accounts for 70-85% of total

revenue at half the clubs.

Clearly, Brighton are more reliant on match day income than

most. In fact, in 2014/15 only two clubs were more dependent on this revenue

stream: Nottingham Forest and Charlton Athletic.

Despite improved results on the pitch, gate receipts fell

for a second consecutive season, decreasing 4% (£0.4 million) from £9.8 million

to £9.4 million, largely due to a lack of home cup ties.

Nevertheless, this is still likely to be the highest match

day revenue in the Championship in 2015/16, as the only team ahead of them in

2014/15 was Norwich City, who were promoted to the Premier League last season. It

will be another story this year, due to the arrival in the second tier of

Newcastle and Villa with their large crowds.

Average attendance slipped slightly from 25,640 to 25,583,

partly due to the knock-on impact of the disappointing 2014/15 season, but this

was still the second highest in the Championship, only surpassed by Derby

County 29,663, though ahead of all three promoted clubs: Middlesbrough 24,627,

Hull City 17,199 and Burnley 16,709.

Since the move to the Amex, attendances had been steadily

rising from the 7,352 at Withdean, as the new stadium finally met latent local

demand for tickets. Brighton’s potential has been highlighted this season by

three games selling out (Norwich, Villa and Fulham). In fact, the club has in

excess of 22,000 season ticket holders and 1901 Club members.

Ticket prices are among the highest in the Championship.

According to the BBC’s Price of Football survey, Brighton has the second

highest cheapest season ticket (only below Norwich) and the third highest most

expensive season ticket (behind Ipswich and Fulham). However, the survey did

note that tickets include a travel subsidy to and from the ground for fans by

public transport or use of the park-and-ride option, valued at £4 per game for

adults.

It is also worth mentioning that Brighton supporters are

happier with their match day experience than any others according to a Football

League study, partly due to the magnificent facilities that are second to none,

including free wi-fi and VIP padded seats. The club is also good to away fans,

lighting the concourse in their colours and having their local beer on tap. The

only fly in the ointment is the appalling “service” from the dreaded Southern

Rail.

The good news is that the club froze most ticket prices in

2015/16 and have restricted price rises in 2016/17 to no more than a couple of

pounds per match. Barber said this was to reward fans for “the ongoing loyalty

and support they’ve shown to the club.”

Brighton’s broadcasting revenue rose 19% (£0.9 million) from

£4.9 million to £5.9 million in 2015/16, which was attributed to an increase in

the Football League basic distribution plus the club being shown more times on

live TV.

In the Championship most clubs receive the same annual sum

for TV, regardless of where they finish in the league, amounting to around £4

million of central distributions: £2.1 million from the Football League pool

and a £2.3 million solidarity payment from the Premier League. There are also

payments for each live TV game: £100,000 home; £10,000 away.

This might not sound much, but Barber argued, “TV income is

extremely important for all clubs, including ours”, adding, “without revenue

from Sky TV, ticket prices would go up.”

However, the clear importance of parachute payments is once

again highlighted in this revenue stream, greatly influencing the top nine

earners in 2014/15. Nevertheless, it should be noted that these payments are

not necessarily a panacea, e.g. Middlesbrough secured promotion last season,

even though their broadcasting income of £6 million was less than half the size

of those clubs boosted by parachutes.

Looking at the television distributions in the top flight,

the massive financial chasm between England’s top two leagues becomes evident

with Premier League clubs receiving between £67 million and £101 million in

2015/16, compared to the £4 million in the Championship. In other words, it

would take a Championship club more than 15 years to earn the same amount as

the bottom placed club in the Premier League.

The size of the prize goes a long way towards explaining the

loss-making behaviour of many Championship clubs. This is even more the case

with the new TV deal that started in 2016/17, which Barber described as

“astonishing”. This will be worth an additional £35-60 million a year to each

club depending on where they finish in the table.

Even if a club were to finish last in their first season in

the top flight and go straight back down, their TV revenue would increase by an

amazing £95 million. They would also receive a further £71 million in parachute

payments, giving additional funds of around £166 million. If they survived

another season, you could throw in another £120 million.

Of course, if they did go up, Brighton would also have to

spend more to strengthen their playing squad, but the net impact on the club’s

finances would undoubtedly be positive, as evidenced by the improvement in the

bottom line for those clubs promoted in the past few seasons.

As we have seen, parachute payments make a significant

difference to a club’s revenue and therefore its spending power in the

Championship. From this season, these will be even higher, though clubs will

only receive parachute payments for three seasons after relegation. My estimate

is £83 million, based on the percentages advised by the Premier League: year 1 –

55%, year 2 – 45% and year 3 – 20%.

The other point worth emphasising is that if a club is

relegated after only one season in the Premier League, it will only benefit

from parachute payments for two years.

There are some arguments in favour of these payments, namely

that it encourages clubs promoted to the Premier League to invest to compete,

safe in the knowledge that if the worst happens and they do end up relegated at

the end of the season, then there is a safety net. However, they do undoubtedly

create a significant revenue disadvantage in the Championship for clubs like

Brighton.

Commercial income grew by 5% (£0.5 million) from £8.9

million to £9.4 million, comprising commercial sponsorship and advertising £5.5

million, catering and events £1.3 million, retail £1.3 million, academy grant

£0.9 million, other income £0.3 million and women and girls £0.1 million. The

main driver for the growth was a £0.4 million increase in catering and events,

primarily as a result of the Rugby World Cup matches hosted at the Amex.

In the new world of FFP, Bloom has said that the club “had

to adapt and move quickly to establish a sharper commercial focus. We had to

focus on the inherent value of our brand.” The club’s success in this area is

reflected by Brighton having one of the highest commercial revenues in the

Championship, only behind Norwich City and Leeds United in 2014/15.

This is despite the fact that Brighton now only report the

net catering commission in revenue, whereas in previous seasons all the gross

revenue was included in revenue with the expenses shown in costs.

"Back on the Shane gang"

What has been particularly impressive in recent years is the

increase in sponsorship, though it remained static in 2015/16, largely due to

the contractual cycles. American Express are not only shirt sponsors, but also

naming rights partner for the stadium and the training ground. This multi-year

agreement, signed in March 2013, was described by Barber as “the biggest in the

club’s history.”

Similarly, Barber said that the 2014/15 Nike deal, replacing

Errea after 15 years as the club’s kit supplier, represented “a significant

increase on our existing commercial arrangement.”

Interestingly, the club has applied for planning permission

for a 150 room hotel alongside the stadium, though the City Council has to date

rejected the application. Barber said that this “would have been a valuable

addition to our non-matchday revenue.” They remain “hopeful of a successful

outcome”, which is just as well as they have to date spent over £2 million on

this development.

Brighton’s wage bill shot up by 33% (£6.7 million) from

£20.6 million to £27.4 million in 2015/16, “in order to be as competitive

possible and give ourselves the best possible chance of success on the pitch.” This

would have included high wages for the returning Bobby Zamora, even though he

arrived on a free transfer.

It is worth noting that since 2012, the first year back in

the Championship, the wage bill has grown by £12.7 million (87%), while revenue

has only increased by £2.5 million (11%).

This is all seen on the pitch, given the significant

reduction in administrative and operational expenses. For example, in 2015/16

the number of players rose from 61 to 73, while other staff were flat at 197.

Despite this growth, Brighton’s £27 million wage bill is

still only the eighth highest in the Championship, so promotion would indeed be

a fine achievement. As a comparative, the top three in the Championship in

2014/15 were Norwich City £51 million, Cardiff City £42 million and Fulham £37

million.

Barber understands this challenge: “We haven’t got anywhere

near the biggest budget in the division. We’re probably 10th or 11th. So we’ve

had to spend wisely, and eke out every ounce of value from every deal.”

That said, it would be no surprise if Brighton’s wage bill

further rose this season, as they have been extending contracts for a number of

important individuals, including Hughton, Beram Kayel, Solly March and Conor

Goldson, though this will ensure a decent price if they are sold.

The remuneration for the highest paid director, who is not

named, but is surely Paul Barber, has increased from £558k to £578k. This is a

lot of money, but Barber is really a

Premier League level chief executive, who has been pretty successful in cutting

operational expenses and renegotiating many of the sponsorships.

Brighton’s wages to turnover ratio increased (worsened) from

87% to 111%, the highest since 2009 when the club was in League One. This is

not exactly great, but it is by no means one of the highest in the

Championship. In 2014/15 no fewer than 11 clubs “boasted” a wages to turnover

ratio above 100% with the worst offenders being Bournemouth 237%, Brentford

178% and Nottingham Forest 170%.

The (relatively) prudent approach is evidently the one that

Brighton want to follow, especially in a FFP world, as noted by Bloom: “While

we do want to play at the highest level, we cannot simply open our cheque book

and start spending without care or attention.”

Other expenses rose by 7% (£1.1 million) from £15.0 million

to £16.0 million, which is by far the highest in the Championship, ahead of

Fulham £13.4 million and Leeds United £12.6 million.

This is the other side of the coin of moving to the Amex, as

this year’s increase was largely due to stadium expenses: maintenance, running

costs and security. There are also some costs that are exclusive to Brighton,

as Barber note, “The contribution that the club makes to the cost of travel has

grown, meaning that we have a large seven-figure transport bill that other

clubs don’t have.”

Non-cash expenses have also been on the rise with

depreciation and player amortisation increasing from just £237k in 2009 to £8.7

million in 2016, reflecting the club’s investment in infrastructure and the

playing squad.

In 2015/16 depreciation was unchanged at £4.9 million, which

is more than twice as much as any other club in the Championship, the next

highest being Derby County £2.1 million. This represents the annual charge of

writing-off the cost of the stadium and the training ground. These are

depreciated over 50 years, i.e. 2% of cost per annum.

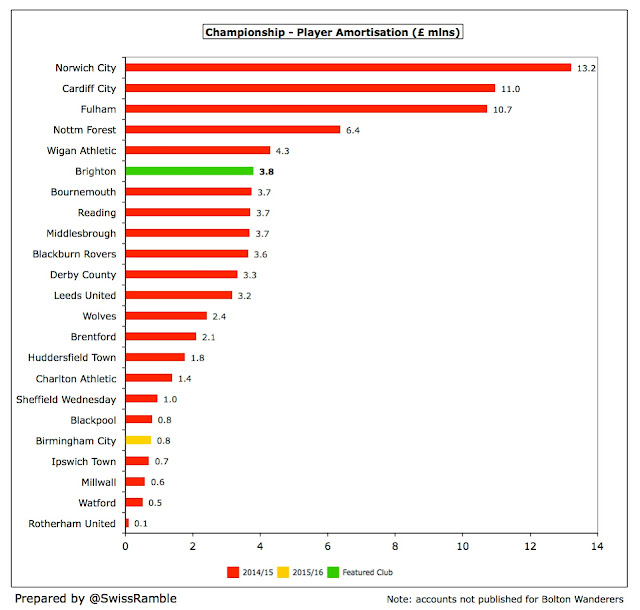

Player amortisation was 60% (£1.4 million) higher at £3.8

million, following the strengthening of the squad, but this not out of the norm

in the Championship. The highest player amortisation in 2014/15 was found at

clubs recently relegated from the Premier League, namely Norwich £13 million,

Cardiff £11 million and Fulham £11 million.

However, to place this into perspective, even these clubs

are miles behind the really big spenders in the top tier like Manchester City

(£94 million) and Manchester United (£88 million). This is partly because there

is no amortisation required for those players who have been developed at the

Academy, e.g. Dunk and March in Albion’s case.

The accounting for player trading is fairly technical, but

it is important to grasp how it works to really understand a football club’s

accounts. The fundamental point is that when a club purchases a player the

transfer fee is not fully expensed in the year of purchase, but the cost is

written-off evenly over the length of the player’s contract, e.g. Irish

international defender Shane Duffy was bought from Blackburn Rovers for a

reported £4 million on a four-year deal, so the annual amortisation in the accounts

for him is £1 million.

Over the years, Brighton have not been a big player in the

transfer market, often registering net sales, though they have increased their

gross spend recently, averaging £5.6 million in the last two seasons, compared

to just £0.9 million over the previous nine seasons.

It is striking that there have been no meaningful sales in

this period, as Barber explained, “Our key objective this summer was to retain

our best players which, despite a lot interest and a number of offers for different

players in our squad, we have managed to do.”

They also wanted to strengthen the squad in key areas this

summer, so recruited Shane Duffy and Oliver Norwood, who made a good impression

at the Euros with the Republic of Ireland and Northern Ireland, and the

returning Steve Sidwell. They have also made good use of the loan market,

bringing in prolific goal scorer Glenn Murray from Bournemouth and full-back

Sebastien Pocognoli from West Brom.

"A French Kiss in the Chaos"

Last season they also bought well with Anthony Knockaert,

Tomer Hemed, Jiri Skalak, Conor Goldson, Liam Rosenior, Jamie Murphy, Gaetan

Bong and Uwe Hünemeier all making decent contributions.

However, it is apparent that Brighton have not gone

overboard in terms of spending, especially compared to some of their principal

rivals who are really “going for it”. To illustrate this, in the last two

seasons Brighton had net spend of 11 million, while they were comfortably outspent

by Derby County £26 million, Norwich City £23 million and Sheffield Wednesday

£21 million.

Not to mention Aston Villa and Newcastle United who have

somehow found themselves in the Championship despite substantial net spend of

£47 million and £43 million respectively. As Hughton said, “There are big

spenders in this division. We can’t compete with what Newcastle and Aston Villa

are doing. What we have done has been sensible.”

Therefore, Brighton have to box clever, as Bloom explained:

“There are other clubs in the division who have spent significantly more than

us. So we just have to make sure we recruit smarter and that the team dynamic

overcomes the financial disadvantage we've got against certain other clubs.”

Although holding onto players was clearly the strategy for this season, Bloom recently indicated at a fans’ forum that things might be different next season, so this may well be Brighton’s best opportunity to get promotion.

Brighton’s net debt rose by £25.6 million from £140.5

million to £166.1 million with the £23.0 million increase in gross debt to

£170.6 million compounded by cash falling by £2.6 million to £4.5 million.

Debt has been rising over the past few years, so much so

that Brighton now have the largest debt in the Championship, substantially more

than other clubs, e.g. Cardiff City £116 million, Blackburn Rovers £104 million

and Ipswich Town £88 million. However, it is entirely owed to Bloom, is

interest-free and can be regarded as the friendliest of debt.

The cash flow statement reveals that Bloom has also

converted £22 million of loans into share capital, including £11 million in

2015/16, which means that Bloom actually stumped up £34 million last season. Furthermore,

since the accounts were published, he converted an additional £8 million of

loans into shares, i.e. a running total of £30 million.

Adding the £80 million that Bloom has funded via share

capital (including the debt conversions) to the £171 million of debt means that

Bloom has put in a total of £251 million – that’s a cool quarter of a billion.

Just pause to let that sink in for a moment. One. Quarter.

Of. A. Billion. Pounds.

As David Jones commented, “That’s a massive amount of money

for an owner to have to subsidise a club for. And when you consider we’ve got

one of the highest two or three attendances in the Championship, some of the

best sponsorship deals, we’re still needing the owner to help us with that kind

of subsidy. It’s substantial.”

Looking at how Brighton have used these funds since Bloom

took charge, the majority (£155 million) has gone on investment into

infrastructure (including £103 million on the stadium and £32 million on the

training centre), while £83 million has been used to bankroll operating losses.

Hardly any money was spent on new players in this period with a net outlay of

less than £5 million.

There were a couple of interesting corporate actions after

the accounts closed. Authorised share capital was doubled from £100 million to

£200 million – potentially paving the way for a significant debt conversion? In

addition, the club created £40 million of Convertible Unsecured Loan Notes.

Being so dependent on one individual can be a concern, but

Bloom comes from a family of Brighton supporters: “I have absolutely no

intention of selling. I think I will be here for many years to come.”

"Hands Held High"

He continued: “Our ambition remains for the club’s teams,

both men and women, to play at the highest level possible – and as chairman

(and a lifelong supporter of the club) I will do everything I possibly can to

achieve that and I remain fully committed to that goal.”

Bloom is seriously wealthy from his property and investment

portfolio (plus money earned from poker and other forms of gambling), but

Brighton are very fortunate to have such a generous benefactor.

As Jones said, “If you’re an ambitious Championship club and

you don’t have the benefit of parachute payments, then you’re going to need an

owner that’s prepared to subsidise you substantially.”

"Sound Czech"

However, Bloom would not be able to simply buy success, even

if he wanted to, as Brighton need to follow the Football League’s FFP

regulations. Under the new rules, losses will be calculated over a rolling

three-year period up to a maximum of £39 million, i.e. an annual average of £13

million, assuming that any losses in excess of £5 million are covered by owners

injecting equity (hence the £8 million debt conversion in July 2016).

These limits are much higher than the previous £6 million a

season, so are likely to encourage clubs to spend even more, making the division

even more competitive.

Brighton have confirmed that they will comply with these

rules in 2015/16 (“as we have done each season”), which might seem strange, given that the

reported £26 million loss was twice the £13 million limit.

"Another Dale in my heart"

This is because FFP losses are not the same as the published

accounts, as clubs are permitted to exclude some costs, such as depreciation, youth

development, community schemes and any promotion-related bonuses.

Brighton’s depreciation was £5 million, which implies that

they have spent £8 million on their academy and the community in order that the

FFP loss was lower than the £13 million limit in 2015/16. Even though these

activities represent a major investment for the Albion, it seems unlikely that

the expenditure would be that high, but it is difficult to see how else the club could have complied.

Going forward, the assessment is calculated over a three-year period, which means that a higher loss one year can

be compensated in later years, e.g. via player sales, or might even become

irrelevant (if the club is promoted).

Either way, Bloom was right when he said it is “a delicate

balancing act for the board, as we strive to achieve our ultimate aim.”

"Spanish Steps"

The last time Brighton were in the top flight was way back

in 1983, but this club is clearly ready for the Premier League. As Bloom said,

“That’s what we built the stadium for, that’s what we built our magnificent

training ground for.”

Bloom appears just as happy with the situation on the pitch:

“To compete at the top end of the Championship, it’s important to have a manager

who knows how to win at this level and to possess a strong group of quality

players. We have both, and while this doe not guarantee promotion, it gives us

an excellent chance.”

Given what happened last season, nobody at the Amex is

taking anything for granted. Barber spoke for everyone: “We’ve made a really

strong start. But we also know that this is the toughest division in the world

and that nothing has been achieved at this point.”