Nottingham Forest have enjoyed a glorious past, albeit

largely relating to one magical period under the legendary Brian Clough and his

assistant Peter Taylor. After gaining promotion from the old Second Division in

1977, Clough’s Forest become Division One champions at the first time of asking

in 1978 and then proceeded to win the European Cup two years in succession. In

the same purple patch, they also picked up two League Cups.

This was a remarkable achievement for a club of Forest’s

size and was testament to the genius of the manager, as the team featured few

superstars. These successes have been wonderfully chronicled in the superlative

documentary and book, “I Believe In Miracles”, which is well worth the

attention of any football fan.

However, recent history has not been so kind. Next season

will be the 18th that Forest have spent outside the Premier League, which is a

shocking indictment for a club that once scaled the heights . Chairman Fawaz Al

Hasawi agreed with this downbeat assessment in his review of the 2014/15

season, which he described as “a time of missed opportunity”.

The Al Hasawi family purchased the club in July 2012 from

the estate of former owner and lifelong fan, Nigel Doughty, after his sad and

premature death. Initially, the Kuwaiti businessmen talked a good match, “We

know there are challenging times ahead of us to bring the club back to its

glory days and we look forward with excitement towards a new successful future.”

"Until I learn to accept my Jamie Ward"

The new owners were also boosted by Doughty’s estate only

taking a £20 million repayment against the outstanding £86 million of loans,

thus enabling the club to move forward with a relatively clean slate.

However, it is fair to say that the Al Hasawi era has not

been a glittering success. While it is true that they have made a substantial

investment into the club, amounting to £67 million of loans as at 31 May 2015, Forest

are no nearer securing a return to the top flight, as they continue to struggle

in the Championship.

Indeed, one damning statistic is that their league position

has deteriorated every season under Al Hasawi: 8th in 2012/13, 11th in 2013/14,

14th in 2014/15 and 16th in 2015/16. In other words, they are now closer to League

One than the Premier League, which is particularly disappointing, given that

they reached the play-offs two seasons in a row as recently as 2009/10 and

2010/11.

The constant managerial upheaval surely cannot have helped

matters. In the four years since the new owners took charge, Forest have had no

fewer than eight people coaching the team, despite Al Hasawi claiming, “I don’t

like to change managers. I like stability.”

"Do your best and don't worry"

They started as they meant to go on, i.e. shambolically, with

four different managers in their first six months, as noted in a magnificent

paragraph in the 2012/13 accounts: “The year started with Steve Cotterill as

football manager. He was replaced in July 2012 by Sean O’Driscoll, who himself

was replaced in December 2012 by Alex McLeish. Alex was only in the position

until February 2013, when he was replaced by the current manager Billy Davies.”

And breathe.

After alienating most people with his somewhat abrasive

style, Davies was sacked after a year with Gary Brazil taking the role on a

caretaker basis (though arguably that’s the only valid description of the

position), before the arrival of fans’ favourite Stuart Pearce. After a

promising start, the team’s form collapsed, so “Psycho” also failed to last a

season.

Next on the chopping block was another former Forest player,

Dougie Freedman, though he was given his P45 in the dreaded February/March period

with coach Paul Williams stepping up to the plate until the end of the season.

Incredibly, Forest are currently without a manager, though many would understandably

think twice before accepting this poisoned chalice.

There has been similar turnover in the important Head of

Recruitment role, while the brief experiment with an experienced chief

executive ended with the resignation of Paul Faulkner, after the former Aston

Villa man claimed that he was not allowed to do his job.

The owners’ strategy has essentially been to throw money at

the problem, resulting in much higher wage bills and increasing debt. To be

fair, the issue has not so much been a lack of investment, but the seeming

absence of any sort of strategic plan, which has resulted in the money being

largely wasted.

"Vaughan in a storm"

This impression has been reinforced by numerous financial

glitches, including late payments to suppliers, failures to pay football clubs

transfer fee installments (e.g. to Peterborough United for striker Britt

Assombalonga) and five (yes, five) winding-up orders, including two this year

alone for non-payment of tax.

Although the club described these problems as “purely

administrative”, this sort of incompetence is never a good sign. One reason offered

for slow payment of wages was “a national holiday in Kuwait”, which is only one

step above “the dog ate my homework”.

Even if Al Hasawi wanted to spend more on the club, he would

not have been able to do so, as the club’s losses resulted in Forest breaching

the Financial Fair Play (FFP) regulations, thus being placed under a transfer

embargo in December 2014.

This catalogue of woe means that it is not overly surprising

that the owners are looking for others to come on board. Indeed, there are

strong rumours that Greek shipping magnate Evangelos Marinakis, the owner of Olympiacos

Piraeus, is poised to buy 80% of Forest.

Although Forest might seem like an attractive proposition,

any new investor would discover a club in a fairly poor financial position, as

seen by the 2014/15 accounts, which featured a loss of £21.5 million.

This actually represented a £2.5 million improvement over

the previous season’s £24.0 million loss, though that included a £1.1 million

restatement following the cancellation of a sponsorship agreement with the Al Hasawi

family (for the shirt and areas around the City Ground).

The main reason for the lower loss was a £4.3 million

increase in profit on player sales to £6.1 million, largely due to the sales of

Jamaal Lascelles and Karl Darlow to Newcastle United.

Revenue also rose by £2.1 million (14%) to £17.4 million,

which Al Hasawi ascribed to “the dedication of the supporters and the work of

the commercial department”. This was reflected in match day income increasing

by £1.0 million (14%) to £8.2 million and commercial income rising by £0.5

million (18%) to £3.1 million.

However, another important factor was income from player

loans climbing £1.0 million to £1.5 million, as a remarkable 12 players were

loaned out, including Radoslaw Majewski, Jamie Mackie, Greg Halford, Dan

Harding and Djamel Habdoun (amongst others). On the other hand, broadcasting

income dropped by £0.4 million (8%) to £4.6 million.

There was another “significant increase” in the wage bill,

which rose £2.5 million (9%) from £27.2 million to £29.7 million, while player

amortisation was up £0.7 million (13%) to £6.4 million. Other expenses slightly

increased to £8.2 million, while interest payable was £0.5 million worse, as

the previous year included a credit after interest previously charged by the

holding company had been waived.

Despite the improvement to the bottom line, only two

Championship clubs reported larger losses than Forest in 2014/15, namely Bournemouth

£39 million and Fulham £27 million. In fairness, hardly any clubs are

profitable in the Championship with only six making money in 2014/15 – and most

of those are due to special factors.

Ipswich Town were top of the pops with £5 million, but that included

£12 million profit on player sales. Cardiff’s £4 million was boosted by £26

million credits from their owner writing-off some loans and accrued interest.

Reading’s £3 million was largely due to an £11 million revaluation of land

around their stadium. Birmingham City and Wolverhampton Wanderers both made £1

million, but were helped by £10 million of parachute payments apiece.

So the only club to make money without the benefit of

once-off positives were Rotherham United, who basically just broke even – and

ended up avoiding relegation to League One by a single place.

Of course, losses are nothing new for Forest, as the last

time they made a profit was back in 2005 – and that was only £1.1 million.

Since then the club has suffered a decade of losses, amounting to an extraordinary £126 million.

This was all meant to change with the arrival of the Al

Hasawi family: “From the club’s perspective the new ownership represented the

end of a period of uncertainty and has allowed the club to once again stabilize

its finances.”

In reality, the deficits have increased with £63 million of

losses being accumulated in the last three years, averaging £21 million a

season. This is more than double the average annual loss of £9 million over the

preceding seven seasons.

As we have seen, part of the 2014/15 improvement was due to

profits made from player sales. These can have a major impact on a football

club’s bottom line, but it’s not an enormous money-spinner outside the Premier

League with the most profit made by Norwich City £14 million, followed by

Ipswich £12 million, Leeds United £10 million and Cardiff City £10 million.

Forest made £6 million from this activity, which was boosted

by the way that player values are accounted, as the major sales (Lascelles and

Darlow) were both homegrown products, so had no value on the balance sheet (as

no transfer fees had been paid). Against that, the club would have absorbed

losses for the large number of players released on free transfers.

Over the years, Forest have made very little money from

player sales. In fact, the last time that they registered a profit above £2.5

million from this activity (before last season) was 2005, when the £5.1 million

(plus an exceptional £1.5 million gain on finance leases) helped produce the

club’s last overall surplus.

In the nine years between 2005 and 2015, the club only

generated a total of £11.5 million profits from player sales, i.e. just £1.3

million a season. In some cases, this can be considered a positive, as it means

that a club is retaining its best players, but here it is more likely to be

because Forest have not had many players that others clubs would want to buy.

There are a few signs that this might be changing, as the

2015/16 accounts will be boosted by the £7 million sale of Michail Antonio to

West Ham, though accounting losses will also be incurred for the release of the

likes of Jamie Mackie. In financial terms, this might be seen as “running to

stand still”, as the reasonably good profits from player sales in 2014/15 did

not prevent a thumping great overall loss.

This is because Forest’s underlying profitability is getting

worse. Most clubs use EBITDA (Earnings Before Interest, Depreciation and

Amortisation) as an indicator of financial health, as this strips out once-off

profits from player trading and non-cash items. This has been consistently

negative at Forest, but has plummeted from minus £2 million in 2005 to minus

£20 million in 2015.

This was one of the worst in the Championship, only better

than Bournemouth, whose minus £25 million was heavily influenced by large

promotion bonuses. In real terms, Forest had the lowest EBITDA, which means

that they are the least profitable club in the division.

To be fair, only three clubs had a positive EBITDA in the

2014/15 Championship (Wolves, Birmingham City and Rotherham) and none of those

clubs generated more than £1.5 million. In stark contrast, in the Premier

League only one club (QPR) reported a negative EBITDA, which is testament to

the earning power in the top flight.

Revenue has only grown by £2.8 million (19%) in the three

seasons since Al Hasawi arrived and even that is a bit misleading, as it

includes £1.5 million of player loans income. This has only been included as

gross income since 2013, as it had previously been netted off against expenses.

Excluding the effect of this accounting restatement, the

real revenue growth is just £1.2 million (8%), which is a long way from the

increases implied by the owners’ 3-5 year plan.

Part of the problem was actually highlighted by the club in

the 2012 accounts, as it explained one of the reasons for the revenue reduction

that year as being “the lower performance of the first team”.

Even after the rise in Forest’s income to £17.4 million,

this is still on the low side and clearly bottom half of the table in the 2014/15

Championship. Although Blackpool and Bolton Wanderers are yet to publish their

accounts, we can safely say that their revenue was higher than Forest, as they

both received £10 million parachute payments.

Therefore, Forest only had the 16th highest revenue in the

Championship, only above eight clubs, though one of these (Bournemouth) did

manage to get promoted. To further place this into perspective, four clubs

enjoyed revenue higher than £35 million (more than twice as much as Forest):

Norwich City £52 million, Fulham £42 million, Cardiff City £40 million and

Reading £35 million.

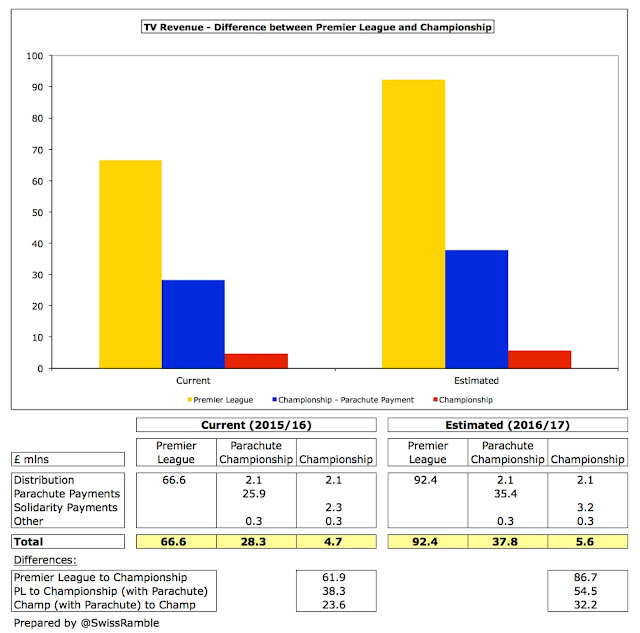

Of course, these revenue figures are distorted by the

parachute payments made to those clubs relegated from the Premier League, e.g.

in 2014/15 this was worth £25 million in the first year of relegation.

However, if we were to exclude this disparity, Forest would

still find themselves back in tenth place. The revenue differentials would be

smaller, though they would be behind different clubs, e.g. the top three would

then be Norwich City £29 million, Leeds United £24 million and Brighton and

Hove Albion £24 million.

The most important revenue stream for Forest is match day,

which contributes 47% of total revenue, followed by broadcasting 26% and

commercial 18%. Player loans accounted for as much as 9% of 2014/15 revenue.

In fact, no club has a greater reliance on match day revenue

in the Championship than Forest’s 47%, ahead of Charlton Athletic 43%, Brighton

and Hove Albion 42%, Millwall 41% and Ipswich Town 40%.

Forest’s match day revenue actually rose by £1.0 million

(14%) to £8.2 million in 2014/15, even though they hosted four fewer cup games,

as the average attendance increased from 22,630 to 23,492, largely due to

having Forest legend Pearce at the helm.

This meant that Forest’s match day revenue was the fourth

highest in the Championship, only behind Norwich City £10.7 million, Brighton

£9.8 million and Leeds United £8.8 million.

In terms of attendance, it was a similar story, as Forest

were the fifth highest, though it would have been somewhat galling to see that

the league leaders were local rivals Derby County with 29,232.

However, to add to Forest’s concerns, attendances fell by a

massive 3,800 (16%) in 2015/16 to 19,676, even though season ticket prices were

frozen, due to a combination of several factors: unhappiness with the owners, the poor football

on display and high ticket prices.

Whatever the reasons, this is the first time that

attendances have dipped below 20,000 since the club was in League One in

2007/08, which is clearly bad news, given how important gate receipts are to

Forest’s business model.

Indeed, Forest have decided to cut ticket prices by 5% for

the 2016/17 season with Al Hasawi explaining the rationale thus, “With loyal

supporters making a financial commitment to support this club I feel it is our

duty to extend the (early bird) offer.” Fair enough, but it could just as easily

be a straightforward acknowledgment of the need to do something to prevent the

crowds falling any further.

Of course, in the Premier League, the vast majority of all

but the elite clubs’ income is derived from broadcasting, but this is not the

case in the Championship. Here, most clubs receive just £4 million of central

distributions, regardless of where they finish in the league, comprising £1.7

million from the Football League pool and a £2.3 million solidarity payment

from the Premier League.

However, the clear importance of parachute payments is once

again highlighted in this revenue stream, greatly influencing the top eight

earners, though it should be noted that clubs receiving parachute payments do

not also receive solidarity payments.

Nevertheless, it should be noted that these payments are not

a panacea, so Middlesbrough secured promotion last season, even though their

broadcasting income of £6.2 million in 2014/15 was less than half the size of

those clubs boosted by parachutes.

Looking at the television distributions in the top flight,

the massive financial chasm between England’s top two leagues becomes evident

with Premier League clubs receiving between £67 million and £101 million,

compared to the £4 million in the Championship. In other words, it would take a

Championship club more than 15 years to earn the same amount as the bottom

placed club in the Premier League.

The size of the prize goes a long way towards explaining the

loss-making behaviour of many Championship clubs and to some extent justifies

Forest’s profligacy. This is even more the case with the astonishing new TV

deal that starts in 2016/17, which will be worth an additional £30-50 million a

year to each club depending on where they finish in the table.

As an example, I have (conservatively) estimated that the

club finishing bottom in the Premier League next season will receive £92

million, which is £87 million more than a Championship club not receiving

parachute payments. Forest might well be a big club, but the TV deals in the

Premier League have risen to stratospheric levels since they last graced the

top flight, so they now have to compete against the realities of the modern

footballing world.

From 2016/17 parachute payments will be even higher, though

clubs will only receive these for three seasons after relegation. My estimate

is £75 million, based on the percentages advised by the Premier League (year 1

– £35 million, year 2 – £28 million and year 3 – £11 million). Up to now, these

have been worth £65 million over four years: year 1 – £25 million, year 2 – £20

million and £10 million in each of years 3 and 4.

There are some arguments in favour of these payments, namely

that it encourages clubs promoted to the Premier League to invest to compete,

safe in the knowledge that if the worst happens and they do end up relegated at

the end of the season, then there is a safety net. However, they do undoubtedly

create a significant revenue disadvantage in the Championship for clubs like

Forest.

Surprisingly for a club of Forest’s admirable tradition,

their commercial income of £3.1 million, up from £2.6 million the previous

season, was one of the smallest in the Championship in 2014/15, way behind

Norwich City £12.8 million, Leeds United £11.3 million and Brighton £8.9

million. In fact, it was only ahead of four clubs: Charlton Athletic £2.5

million, Brentford £2.4 million, Millwall £1.9 million and Wigan £1.5 million.

Forest’s commercial income is made up of sponsorship,

royalties and advertising £0.8 million, match day hospitality, events and

catering £1.8 million and merchandising £0.6 million.

One of the reasons for Forest’s low commercial revenue is

their merchandising deal with Kitbag, though this ended in June 2015, so next

year’s accounts should see some upside. That said, there is considerable room

for improvement in the commercial arena when you consider that local Midlands

rivals, Derby County and Wolves, both generate around £8 million a year from

this activity.

"Shout, shout, let it all out"

For the past three seasons Forest’s shirt has been

emblazoned with the name of one of the owner’s companies, namely Fawaz

Refrigeration & Air Conditioning. Although the chairman described this as a

“lucrative” deal, he did admit that he would have preferred to secure an

external sponsor, and he has now done so. From the 2016/17 season, Forest will

have online betting firm 888 Sport as its shirt sponsor.

It remains to be seen whether some of the sponsorship areas

around the stadium will be continued to be utilised by companies controlled by

the Al Hasawi family at no charge. Either way, it feels a long way from the

days when Fawaz claimed that Forest’s revenue issues would be addressed in the

form of new sponsorship from several companies in Kuwait.

The current three-year kit supplier partnership with Adidas

runs until the end of the 2016/17 season.

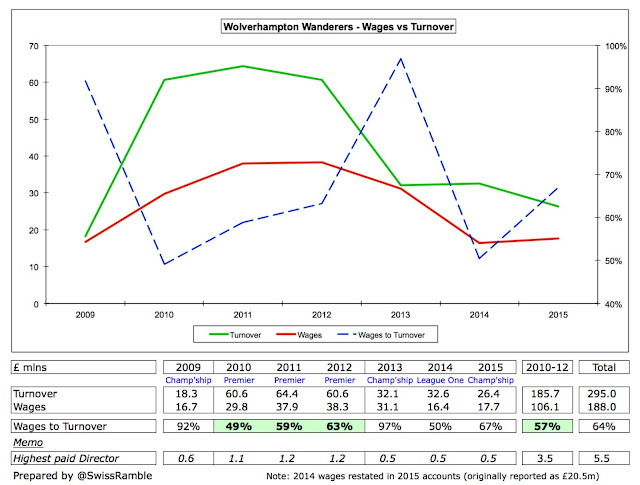

Forest’s wage bill rose by 9% (£3 million) from £27 million

to £30 million in 2014/15, which means that wages have increased by a

staggering 69% (£12 million) in the three years since Al Hasawi arrived, while

revenue only grew by 19% (£3 million) in the same period, thus pushing the

wages to turnover ratio up to an awful 170%.

As the club observed, “the owners gave significant support

to football management in an effort to support the promotion bid.” In a way,

that is laudable, though it is unclear how much is included in the wage bill

for pay-offs to all the sacked managers (and their backroom staff).

This is the price Forest have paid for their frequent

changes at the top, perhaps the worst example being Billy Davies being sacked

just six months after being awarded a four-year contract.

In any case, the last time that Forest had a wages to

turnover ratio below 100% was back in 2009. Of course, wages to turnover

invariably looks terrible in the Championship with no fewer than 10 clubs

“boasting” a ratio above 100%, but Forest’s 170% was the third highest (worst),

only behind Bournemouth 237% and Brentford 178%.

Given that, it might come as something of a surprise then to

see that Forest’s wage bill of £30 million was actually only the seventh

highest in the Championship, behind Norwich City £51 million, Cardiff City £42 million,

Fulham £37 million, Reading £33 million, Bournemouth £30 million and Blackburn

Rovers £30 million – though it was almost £10 million more than Watford, who

were promoted that season.

Stop me if you’ve heard this before, but this was once again

because most of these clubs enjoyed the benefit of parachute payments. If we

look at clubs who did not receive such payments, then Forest had the second highest

wage bill, only £700k behind Bournemouth, whose wages were significantly inflated

by substantial promotion bonus payments, but £8 million above Derby County. In other words, Forest's wages were effectively the highest of any club not receiving parachute payments - and by some distance.

It is likely that the wage bill will fall in 2015/16

following the departure of some high earners (and lower termination pay-offs), but it will

still be a real challenge for the club to control this while giving themselves

the best chance of promotion.

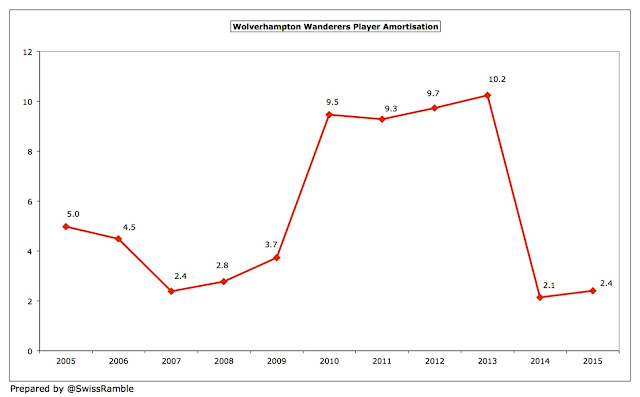

Another aspect of player costs that has been steadily rising

at Forest is player amortisation, which is the method that football clubs use

to expense transfer fees. In line with the higher sums spent on bringing

players into the club, player amortisation has grown under the current

ownership from £2.5 million in 2012 to £6.4 million in 2015.

As a reminder of how this works, transfer fees are not fully

expensed in the year a player is purchased, but the cost is written-off evenly

over the length of the player’s contract via player amortisation. As an

illustration, if Forest were to pay £5 million for a new player with a

five-year contract, the annual expense would only be £1 million (£5 million

divided by 5 years) in player amortisation (on top of wages).

Although Forest’s player amortisation might not seem a huge

charge, it was actually the fourth highest in the Championship, only surpassed

by those clubs relegated from the Premier League in recent times, i.e. Norwich

City, Cardiff City and Fulham. Of course, this expense should have come down in

2015/16 following the transfer embargo and release of many players.

The other side of that coin is that player values on the

balance sheet have also increased, more or less tripling from £3.1 million in

2012 to £9.2 million in 2015. That is the accounting value in the books, but

the actual market value would obviously be much higher if Forest were to sell

any of its players, as homegrown players have zero value in the accounts.

It will not have escaped the supporters’ attention that the

performances on the pitch have actually worsened as both wages and player

values have increased, which is not how these things generally work. As The

Blow Monkeys once sang, “It doesn’t have to be this way.”

In fairness to Al Hasawi, one thing that he cannot be

accused of is failing to back his managers in the transfer market. Even with

the impact of the transfer embargo, Forest have made gross purchases of £23

million in his four seasons, compared to only £9 million in the preceding four

seasons.

On the other hand, there has also been an increase in player

sales from virtually nothing between 2008 and 2012 to £17 million in the last

four years, so net spend has overall decreased.

Clearly, Forest have had to act smarter since the embargo

was put in place, so they have made some astute free signings such as Matt

Mills, Jamie Ward and Daniel Pinillos. They have also dipped into the loan

market with good contributions from the likes of Nelson Oliveira, Ryan Mendes,

Bojan Jokic and Gary Gardner.

As a result of the transfers of Antonio, Lascelles and

Darlow, Forest had £4 million of net sales over the last two seasons. This

meant that they were comfortably outspent by the likes of Derby County £29

million, Middlesbrough £23 million and Burnley £14 million.

In fact, the two automatically promoted clubs and the four

that qualified for the play-offs filled six of the seven top places in the net

spend league, which underlines how much Forest have been hit by the transfer

embargo, so it is good news that the chairman has confirmed this has recently

been lifted (though there is nothing to this effect on the Football League

website).

Forest’s net debt significantly increased in 2015 from £52.0

million to £82.1 million, as gross debt rose by £29.5 million from £52.6

million to £82.2 million and cash fell £0.5 million from £0.6 million to just

£0.1 million.

Virtually all of the debt is owed to the club’s owner, either

directly to the Al Hasawi family (£67 million) or indirectly via the loan from

the parent company, NFFC Group Holdings Limited, £14.9 million. No interest is

charged on these loans, which are only repayable when the club “is in a

position to do so”, so this could therefore be considered “soft” debt. Other football club owners have gone a stage further by converting much of their debt into

equity, though last month Al Hasawi did convert £8 million into capital.

Indeed, after the takeover the estate of Nigel Doughty

allowed £66 million of their outstanding debt to be capitalised. As the club said,

that represented a “considerable and significant improvement to the balance

sheet.” The remaining balance of £20 million was repaid using funds provided by

the parent company. However, just three years later, Forest’s debt is back up

to the pre-capitalisation levels.

Forest’s was by no means the largest debt in the Championship,

being lower than six other clubs. In fact, four clubs had debt over £100

million, including Brighton £148 million, Cardiff City £116 million and

Blackburn Rovers £104 million. Bolton Wanderers have not yet published their

2015 accounts, given their much-publicised problems, but their debt was a

horrific £195 million in 2014.

That said, the vast majority of this debt is provided by

owners and is interest-free, so the amounts paid out by Championship clubs in

interest is a lot less than you might imagine.

In addition to the financial debt, Forest owed £2 million in

transfer fees, while they also had quite high contingent liabilities of £6.6

million, up from £4.3 million, for player purchases and first team management

changes.

The accounts state that the club “relies on the continued

support of the Al Hasawi family for its day to day funding and funds its

working capital requirements through a facility provided by the Al Hasawi

family.” This is clearly seen in the 2015 cash flow statement.

Even after adding back non-cash items such as player

amortisation and depreciation, then adjusting for working capital movements, Forest

made a substantial cash loss from operating activities of £23.9 million. They

then spent a net £5.7 million on player recruitment and £0.5 million on capital

expenditure. This was funded by an additional £29.7 million loan from Al Hasawi.

One other point worth noting is the increase in creditors in

2013 and 2014, which meant that the club was effectively funding some of its

expenditure by the old trick of paying suppliers later.

Of course, it is nothing new for Forest to rely on their

owner for financial support, as it was much the same story under Doughty with

the only real source of funds being additional shareholder loans. In fact,

since 2005 around £127 million has been provided by the club’s owners with

almost 70% (£88 million) of that money being used purely to cover operating

losses.

Only £14 million was used for player purchases (net), while

over £18 million went on sorting out the finances: reduction in overdraft £9.8

million, loan repayments £6.7 million and interest payments £1.8 million.

What is striking is how little money (only £6.6 million) has

been spent on infrastructure investment, so there have been virtually no

improvements to the stadium or the academy. This is in stark contrast to clubs

like Brighton and Brentford where the owners have also provided ample funding,

but large amounts have been invested in their long-term future.

It is also true that there has been an increase in financial

dependency under Al Hasawi with the family needing to pump in £67 million in

just three years. As a comparison, Doughty had to stump up a similar sum (£65 million) over

the preceding eight years.

"It looks like Daniel"

As we have already noted, Forest’s 2013/14 loss meant that

they breached the Financial Fair Play regulations, resulting in a transfer

embargo. The Football League simply stated that the club had “exceeded the

maximum permitted deviation of £6 million – consisting of a maximum adjusted

loss of £3 million plus a further maximum of £3 million of shareholder

investment.”

It should be noted that FFP losses are not the same as the

published accounts, as clubs are permitted to exclude some costs, such as youth

development, community schemes, promotion-related bonuses and infrastructure

investment (such as stadium improvements and training ground). That said, this

does not really help Forest’s FFP

calculation that much, as they have spent so little in these areas.

Instead, this will remain a major issue for the owners, as

they noted in the accounts: “Preparation to meet the challenges of FFP also

adversely affected the season as management worked tirelessly behind the scenes

to thrive in the changed environment.”

That may be, but it is somewhat surprising that they took so

long to wake up to the realities of FFP, given that the 2012 accounts

explicitly stated that this “will be a challenge for the new owners.”

From the 2016/17 season the regulations will change to be

more aligned with the Premier League, so that the losses will be calculated

over a three-year period up to a maximum of £39 million, i.e. an annual average

of £13 million. This will likely encourage clubs to “go for it” even more.

"Many Happy Returns"

Any renewed spending may well be under new ownership, as Al

Hasawi has tired of the criticism: “If people are pushing and always negative,

and there is no appreciation, why should I continue? Maybe there are some

people better than me and I am doing it wrong.”

The obvious answer would be that few could do worse, but it

might be a case of “out of the frying pan and into the fire” if the rumours are

true about Olympiacos owner Evangelos Marinakis buying into the club. He is

currently banned from any “football activity” in Greece with the public

prosecutor’s dossier containing a lengthy list of allegations, including

blackmail, fraud and bribery.

In any case, Forest fans would not have seen the last of Al Hasawi,

who would like to stay on as chairman: “Whatever happens, it is not going to be

a sale of the club. I want this club to win promotion and I want to be here

when it happens.”

Even after all the misadventures on his watch, Al Hasawi is still optimistic,

“I hope this will be a positive summer, because I want to do things right. I

want this to be the time we get it right.” On the plus side, key players like

Assombalonga and Chris Cohen are returning from lengthy injuries, but the lack

of a manager does not exactly inspire confidence.

Realistically, the chances of a return to the Premier League appear further away than ever. The Championship is a tremendously competitive league and Forest seem ill-equipped to mount a serious challenge against those clubs benefitting from hefty parachute payments – or even those with wealthy owners who have a good understanding of the game. Unless, of course, you do believe in miracles.

Realistically, the chances of a return to the Premier League appear further away than ever. The Championship is a tremendously competitive league and Forest seem ill-equipped to mount a serious challenge against those clubs benefitting from hefty parachute payments – or even those with wealthy owners who have a good understanding of the game. Unless, of course, you do believe in miracles.